December 2024 top M&A deals in emerging markets by region

By EMIS M&A Team

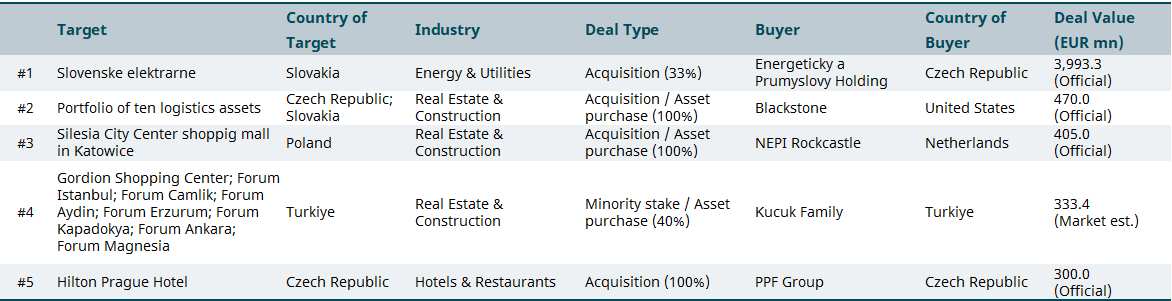

Emerging Europe

Czech investment firm Energetický a Průmyslový Holding (EPH) has agreed to acquire an additional 33% stake in Slovakian electricity producer Slovenské Elektrárne from Italy’s Enel, bringing its total stake to 66%. The deal, valued at approximately EUR 4bn (USD 4.2bn), includes EPH guaranteeing the repayment of Enel’s EUR 970mn credit facilities and EUR 158mn in accrued interest. This acquisition grants EPH control over Slovakia’s largest electricity producer, which now generates power solely from carbon-free sources. Enel’s exit aligns with its strategic portfolio reshaping, while EPH strengthens its presence in Central Europe’s energy market with this key acquisition.

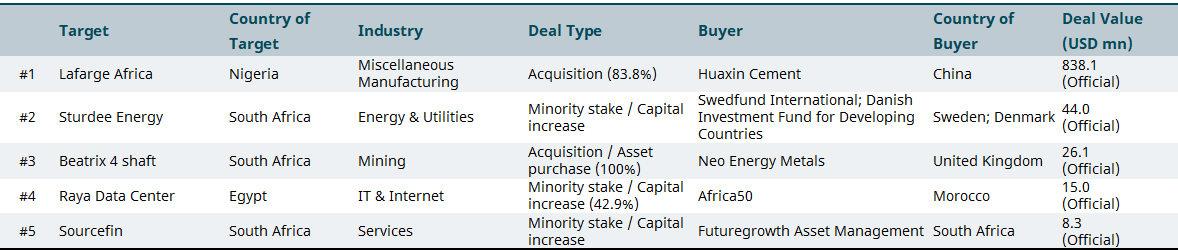

Middle East & Africa

Chinese cement giant Huaxin Cement Co Ltd has agreed to acquire an 83.8% stake in Nigerian-listed Lafarge Africa from Holcim, the Swiss-based cement and building materials producer, for USD 838.1mn. The transaction marks Holcim’s exit from the Nigerian market after 65 years of operation. Lafarge Africa operates four cement plants and six concrete plants across Nigeria. The acquisition aligns with Huaxin Cement’s strategy to expand its global footprint and leverage Lafarge Africa’s established presence in the Nigerian market.

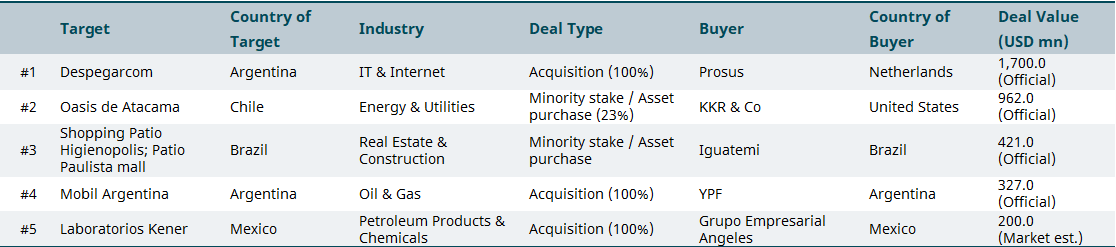

Latin America and the Caribbean

Dutch technology investor Prosus agreed to acquire NYSE-listed Argentinian travel tech company Despegar for an enterprise value of approximately USD 1.7bn. Prosus aims to strengthen its Latin American presence, leveraging its ecosystem, operational expertise, and AI capabilities to accelerate Despegar’s growth. Despegar, a leading online travel platform in Latin America, generated USD 706mn in revenue in 2023.

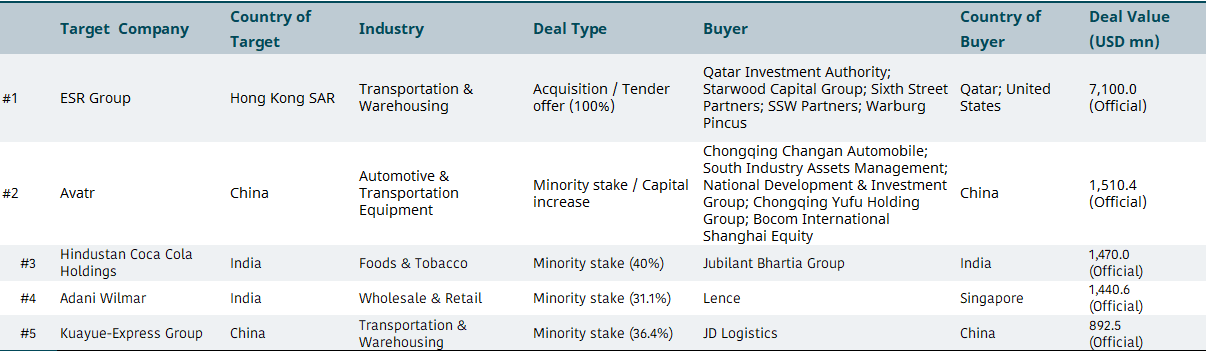

Emerging Asia

Hong Kong-listed real estate manager ESR Group was offered to be taken private by a consortium led by Starwood Capital Group and Warburg Pincus, valuing the company at HKD 55.2bn (USD 7.1bn). Warburg Pincus, a 14% shareholder, will roll over its stake, signaling confidence in ESR’s future. The move aims to restructure ESR for long-term growth in the logistics real estate sector across Asia’s key markets.

Are you interested in M&A intelligence? Request a demo of our platform here