Who's buying whom? The billion-dollar deals reshaping emerging markets

🏝️ Hyatt’s USD 2.6bn Move in Latin America and Other Emerging Market M&A Highlights

From green energy in India to hospitality in the Caribbean, March was a busy month for strategic M&A moves in emerging markets.

Key takeaways:

- 🏨 Hyatt acquires Playa Hotels & Resorts and reinforces its all-inclusive strategy

- 🌱 India accelerates its green transition with ONGC-NTPC’s latest acquisition

- 📡 Telecom reshuffling in Serbia: United Group sells SBB

- 💧 ACWA Power strengthens its presence in the Gulf with a major utilities deal

- 📍 Regional highlights from Emerging Europe, Middle East & Africa, Latin America and Emerging Asia

Hyatt to Acquire LatAm-Focused Playa Hotels & Resorts for USD 2.6bn

U.S.-based hospitality giant Hyatt Hotels Corporation announced plans to acquire the remaining 90.6% stake it does not already own in Playa Hotels & Resorts for USD 2.6bn, including USD 900mn in net debt.

This move deepens Hyatt’s strategic commitment to the all-inclusive resort segment, a journey that began in 2013 with its initial investment in Playa. That early partnership led to the successful creation of the Hyatt Ziva and Hyatt Zilara brands, operated by Playa in top beach destinations across Mexico, Jamaica, and the Dominican Republic.

Through this acquisition, Hyatt will:

- Gain a portfolio of high-quality beachfront assets

- Strengthen its all-inclusive operational expertise

- Secure long-term management rights over key resorts

It also expands Hyatt’s distribution reach by integrating Playa’s resorts into the ALG Vacations and Unlimited Vacation Club platforms, enhancing its global loyalty ecosystem.

The transaction aligns with Hyatt’s asset-light growth strategy. While assuming management control, Hyatt plans to divest Playa’s owned real estate assets, targeting USD 2bn in proceeds by 2027. Over 80% of the acquisition will be financed via new debt — to be repaid largely through these asset sales.

This acquisition follows Hyatt’s 2021 purchase of Apple Leisure Group and its 2024 joint venture with Grupo Piñero, which brought Bahia Principe Hotels & Resorts into Hyatt’s Inclusive Collection. With these moves, Hyatt now boasts over 55,000 rooms across Latin America, the Caribbean, and Europe under its all-inclusive portfolio.

Playa Hotels & Resorts currently owns and/or manages 24 resorts totaling over 8,600 rooms in prime leisure destinations. Hyatt’s broader portfolio includes more than 1,300 properties across 70+ countries, reinforcing its position as one of the world’s leading hospitality brands.

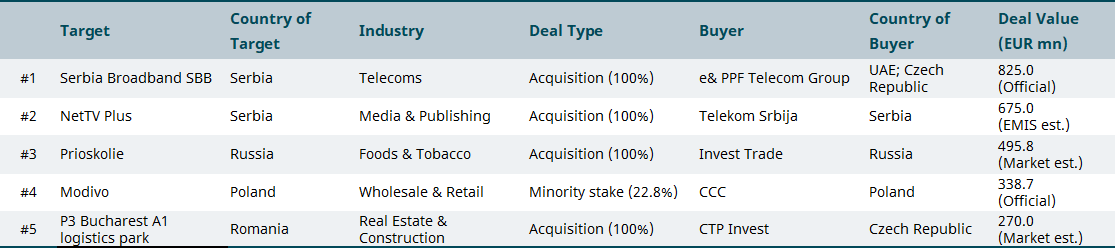

February 2025 – Top Emerging Market M&A Deals by Region

🌍 Emerging Europe

United Group divests Serbian telecom business for EUR 825mn

Balkan telecom and media player United Group agreed to sell SBB doo Belgrade (Serbia) to e& PPF Telecom Group for EUR 825mn, as part of its broader divestment strategy. The buyer, a joint venture between UAE-based e& (formerly Etisalat) and Czech-based PPF Group, will merge SBB’s broadband and pay-TV services with its Serbian mobile operator Yettel — strengthening its local position.

SBB is one of Serbia’s leading telecom operators, with over 700,000 active customers and EUR 257mn in revenue generated in 2023.

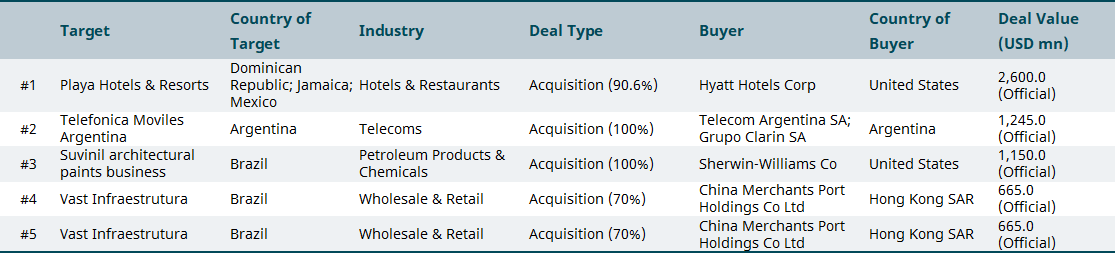

🌎 Latin America & the Caribbean

Hyatt consolidates Playa Hotels & Resorts for USD 2.6bn

The U.S. hotel giant announced the acquisition of the remaining 90.6% stake it did not own in Netherlands-based Playa Hotels & Resorts for USD 2.6bn, including USD 900mn in net debt. Playa owns and operates a portfolio of beachfront resorts in Mexico, Jamaica, and the Dominican Republic.

The deal boosts Hyatt’s portfolio and reinforces its leadership in the all-inclusive segment.

🌅 Middle East & Africa

ACWA Power enters Kuwait with USD 693mn utility deal

Saudi-based ACWA Power signed a USD 693mn agreement to acquire stakes in four power and water desalination assets in Kuwait and Bahrain from France’s ENGIE. The assets include 4.61 GW of gas-fired power capacity and 1.11 million m³/day of desalinated water, along with related O&M firms.

The acquisition marks ACWA’s debut in Kuwait and supports its goal of tripling assets under management to USD 250bn by 2030.

🌱 Emerging Asia

India’s ONGC NTPC Green acquires Ayana Renewable for USD 2.3bn

ONGC NTPC Green — a joint venture between India’s Oil and Natural Gas Corporation (ONGC) and NTPC Ltd — acquired Ayana Renewable Power Pvt for USD 2.3bn. Sellers include the National Investment and Infrastructure Fund (NIIF), British International Investment, and EverSource Capital.

Ayana brings a strong solar, wind, and hybrid asset base to the JV, supporting both ONGC’s and NTPC’s net-zero targets for 2038 and 2050, respectively.

Stay Ahead of Emerging Market Deal Flow

Every quarter, bold strategies are reshaping the global investment landscape. With EMIS Insights, you gain a front-row seat to key transactions, market entries, and cross-border investments in the world’s fastest-growing economies.

📞 Want to see how our platform can elevate your M&A strategy in emerging markets?

Book a personalized demo with one of our specialists and discover how to access actionable data, exclusive insights, and real-time competitive intelligence.

📝 Source: EMIS Insights – Industry Report.