November 2024 top M&A deals in emerging markets by region

By EMIS M&A Team

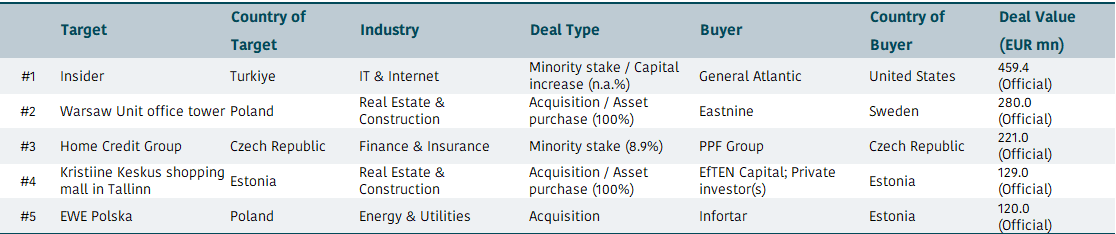

Emerging Europe

Insider, a Turkish-origin global SaaS marketing solutions provider, secured USD 500mn in a Series E funding round led by U.S.-based growth investor General Atlantic, raising its total funding to USD 774mn and valuation to USD 1.2bn. Founded in 2012, Insider offers a platform for personalized omnichannel marketing across 12+ channels, serving clients in 28 countries. The funds will fuel R&D, AI development, and expansion in the U.S. market while supporting strategic M&A opportunities.

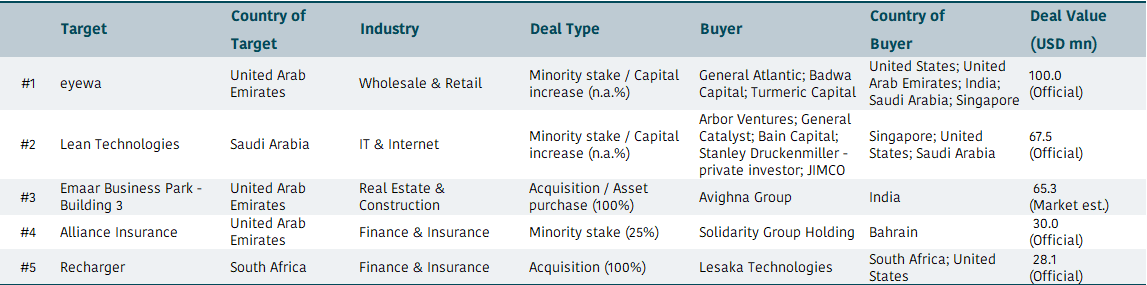

Middle East & Africa

UAE-based eyewear retailer eyewa raised USD 100mn in a Series C funding round led by General Atlantic, with participation from Badwa Capital and Turmeric Capital. The funds will support R&D, talent acquisition, and the opening of 100+ new stores in 2025. Founded in 2017 as an online business, eyewa now operates over 150 locations across the GCC and is the region's largest eyewear retailer. The company is also opening a production center in Riyadh with a warehouse, fulfillment center, and lens manufacturing facility to enhance supply chain efficiency.

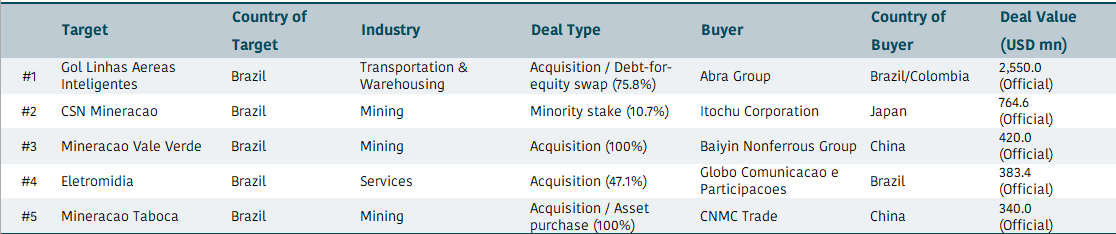

Latin America and the Caribbean

Brazilian airline GOL Linhas Aéreas reached a USD 2.6bn debt-for-equity deal with Latin American airline group Abra, affiliates, and unsecured creditors to exit bankruptcy. Under the deal, Abra will receive new GOL equity, or 75.8% of the enlarged share capital. GOL operates 138 Boeing 737 aircraft and employs over 14,000 professionals. Grupo Abra, formed in 2022, owns Avianca and GOL and holds a strategic investment in Wamos Air.

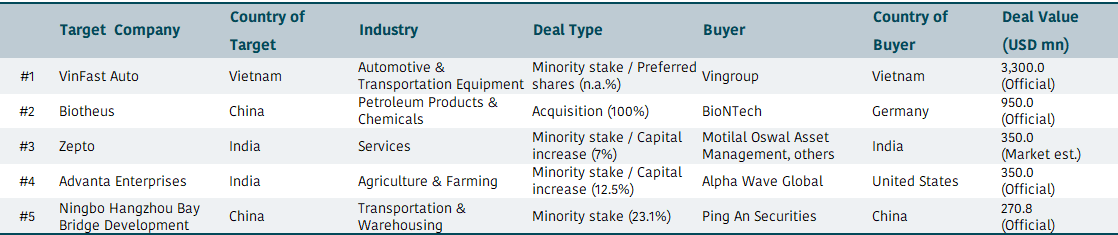

Emerging Asia

VinFast, Vietnam's leading EV maker, has secured a USD 3.5bn funding package from its parent company Vingroup and chairman Pham Nhat Vuong to bolster its financial foundation and accelerate global expansion. As part of the deal, Vingroup converted USD 3.3bn in loans into preferred shares, reducing short-term financial pressure while maintaining its stake.

Are you interested in M&A intelligence? Request a demo of our platform here