June 2025 top M&A deals in emerging markets by region

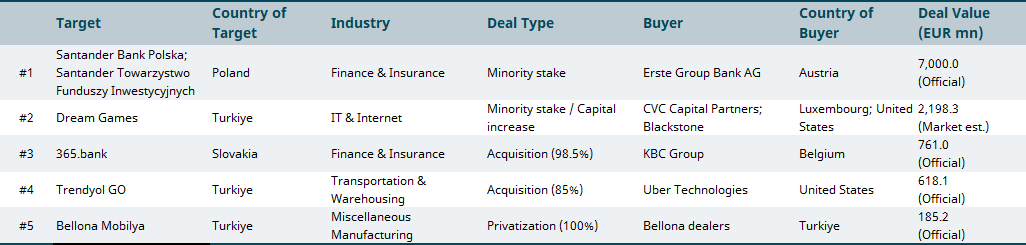

Eastern Europe

Austrian Erste Group will acquire a 49% stake in Santander Bank Polska, and 50% of fund manager Santander TFI for EUR 7bn in an all-cash deal. Funded through internal resources, including a cancelled share buyback and reduced 2025 dividend payout, the deal values Santander Bank Polska at 2.2x its Q1 2025 tangible book value. The acquisition of Poland's third-largest bank significantly expands Erste’s footprint in one of Europe’s fastest-growing and most profitable banking markets.

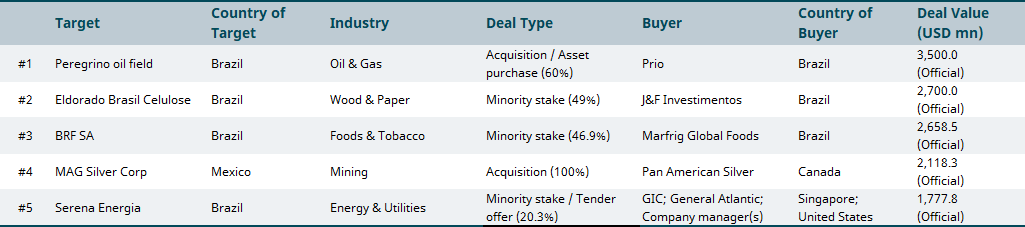

Latin America and the Caribbean

Brazilian oil and gas company Prio (formerly PetroRio) has agreed to acquire a 60% stake in the Peregrino oilfield from Norway’s Equinor for up to USD 3.5bn. The transaction adds 202 million barrels in 1P+1C reserves and resources. Peregrino is located in the Campos Basin east of Rio de Janeiro and is a heavy oilfield that includes a floating production storage and offloading (FPSO) platform, supported by three fixed platforms.

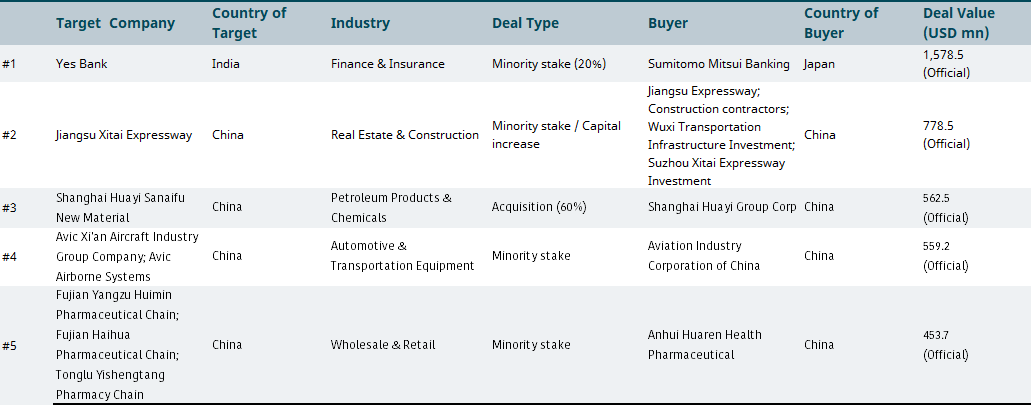

Emerging Asia

Japan’s Sumitomo Mitsui Banking Corporation (SMBC) announced it will acquire a 20% stake in India’s Yes Bank Ltd for USD 1.57bn. The stake will be purchased from a consortium of Indian lenders, including ICICI Bank, SBI, HDFC Bank, Axis Bank, and others. The transaction, pending approvals from India’s RBI and CCI, gives SMBC strategic access to India’s high-growth financial services sector and aims to boost trade and capital flows between Japan and India. It also supports Yes Bank’s growth and profitability by leveraging SMBC’s global expertise.

Are you interested in M&A intelligence? Request a demo of our platform here