July 2025 top M&A deals in emerging markets by region

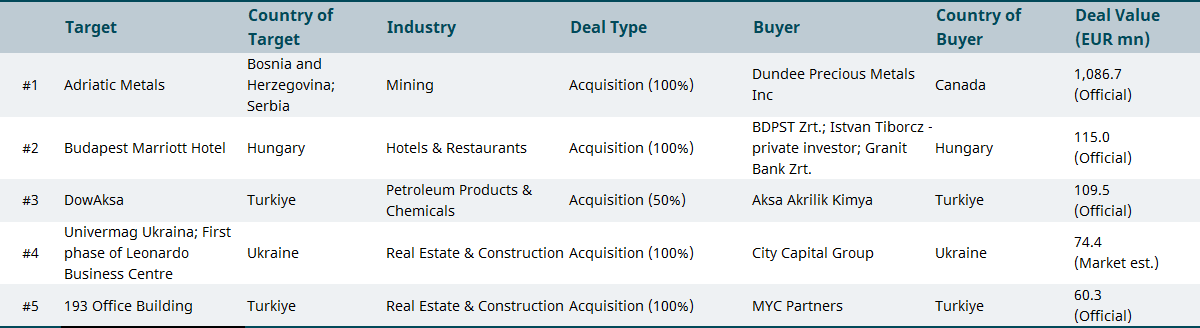

Eastern Europe

Canadian miner Dundee Precious Metals will acquire Bosnia-focused Adriatic Metals in a USD 1.25 bn deal to boost its gold-equivalent output and diversify its portfolio. The transaction, expected to close in Q4 2025, offers Adriatic shareholders cash payment and new Dundee shares. Post-deal, Dundee shareholders will own 75% of the combined entity. The acquisition will add Adriatic’s high-potential Vares Silver Project in Bosnia and Raska Project in Serbia, supporting Dundee’s strategic aim to increase production to 425,000 oz gold equivalent by 2027.

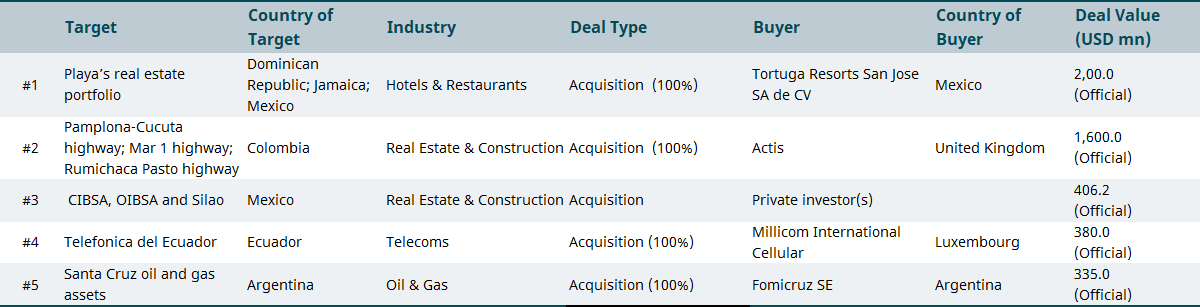

Latin America and the Caribbean

U.S. hotel chain Hyatt has agreed to sell the real estate portfolio of Playa Hotels & Resorts to Mexico-based Tortuga Resorts San Jose for USD 2 billion, with the potential to earn up to USD 143 million in performance-based earnouts. The sale includes 15 all-inclusive resort assets across Mexico, the Dominican Republic, and Jamaica.

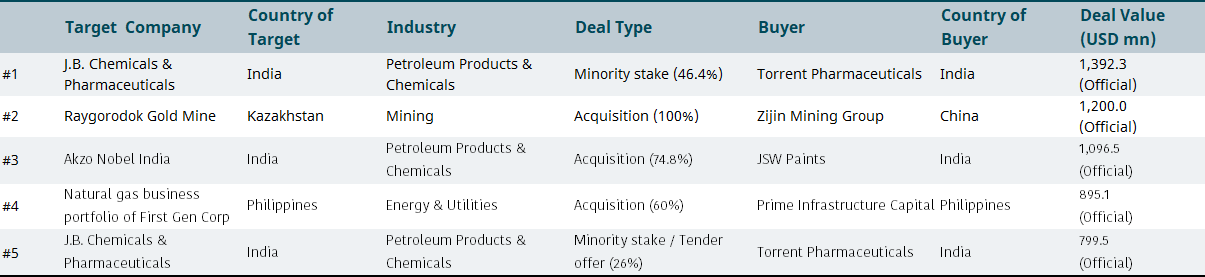

Emerging Asia

India’s Torrent Pharmaceuticals will acquire a 46.4% stake in JB Chemicals & Pharmaceuticals from PE firm KKR & Co for (USD 1.4 bn) and will introduce a mandatory open offer for an additional 26% stake. A potential merger may follow, offering 51 Torrent shares for every 100 JB shares. The acquisition will enhance Torrent’s domestic and global market position, expand its product portfolio, and strengthen its presence in key therapeutic areas across India and international markets.

Are you interested in M&A intelligence? Request a demo of our platform here