July 2024 top M&A deals in emerging markets by region

By EMIS DealWatch

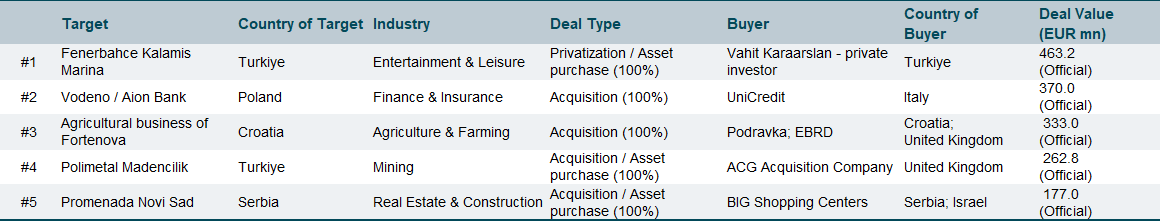

Emerging Europe

Turkish entrepreneur Vahit Karaarslan placed the highest bid of USD 505mn in the privatization tender for Istanbul’s Fenerbahce Kalamis Marina, securing the right to operate it for 40 years. Fenerbahce Kalamis Marina is the city’s largest yacht marina, has a capacity of 1,508 yachts. Mr. Karaarslan has businesses in agriculture, fuel, real estate, and construction.

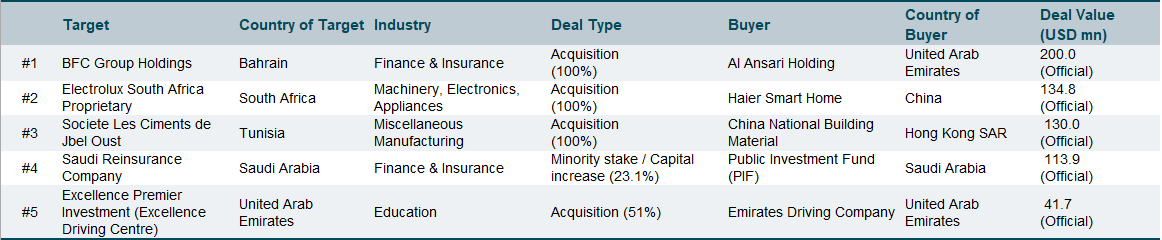

Middle East & Africa

UAE-based Al Ansari Financial Services (AAFS), a subsidiary of Al Ansari Holding, agreed to acquire Bahrain-based money transfer firm BFC Group for USD 200mn. The acquisition will expand AAFS' presence, making it the largest remittance and exchange provider in the GCC by branch network, increasing its branches by 60% to 410 across the UAE, Bahrain, Kuwait, and India. AAFS offers cross-border payments, foreign currency exchange, and other services to retail and corporate clients across various sectors.

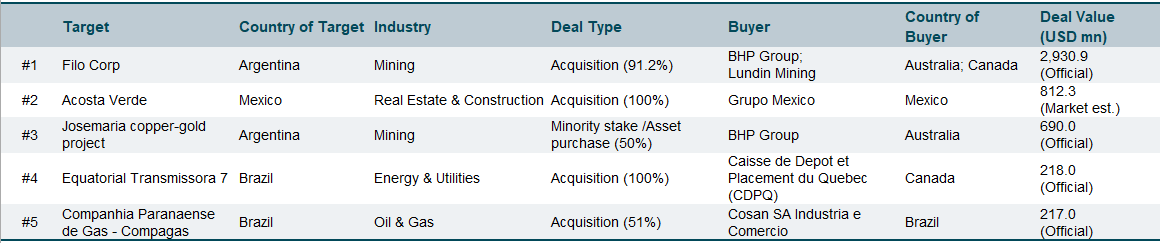

Latin America and the Caribbean

Global mining giants BHP and Lundin Mining announced a CAD 4.1bn (USD 2.9bn) deal to jointly acquire Argentina-focused copper miner Filo Corp. The two companies will form a 50/50 joint venture to manage Filo's projects. Filo Corp owns the Filo del Sol copper-gold-silver project in San Juan, with significant copper, gold, and silver resources. Additionally, BHP will acquire 50% of the Josemaria copper-gold project in Argentina from Lundin for around USD 690mn.

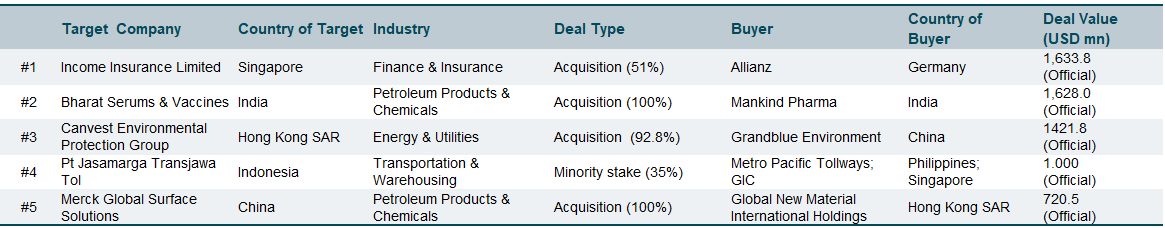

Emerging Asia

German insurer Allianz will acquire a 51% stake in Singapore-based Income Insurance for USD 1.6bn, with the deal expected to close by Q1 2025. The acquisition will strengthen Allianz's presence in Singapore's expanding insurance market, making it a top player in the P&C, Health, and Life segments. Founded in 1970, Income Insurance offers life, health, and general insurance. Allianz, founded in 1890 and headquartered in Munich, serves 126 million customers worldwide and reported assets of EUR 983.2bn in 2023.

Are you interested in M&A intelligence? Request a demo of our platform here