February 2025 top M&A deals in emerging markets by region

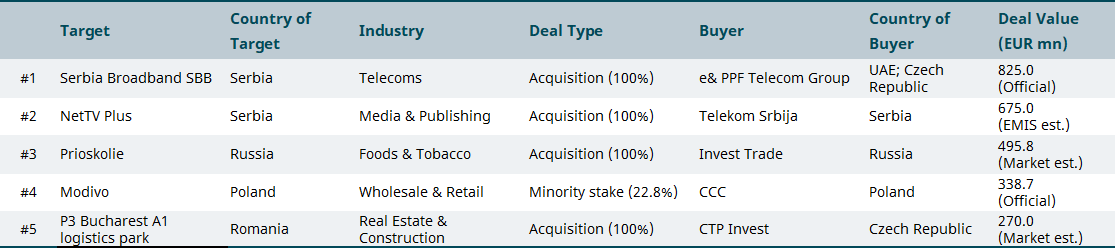

Emerging Europe

Balkan telecoms and media company United Group agreed to sell Serbian telecom SBB doo Belgrade to e& PPF Telecom Group for EUR 825mn, as part of a broader divestment strategy. e& PPF Telecom Group, a joint venture between UAE-based e& (formerly Etisalat) and Czech-based PPF Group, will integrate SBB’s broadband and pay-TV services with its Serbian mobile operator Yettel, enhancing its local service offerings. SBB, a leading Serbian telecom provider with over 700,000 active customers, generated EUR 257mn in revenue in 2023.

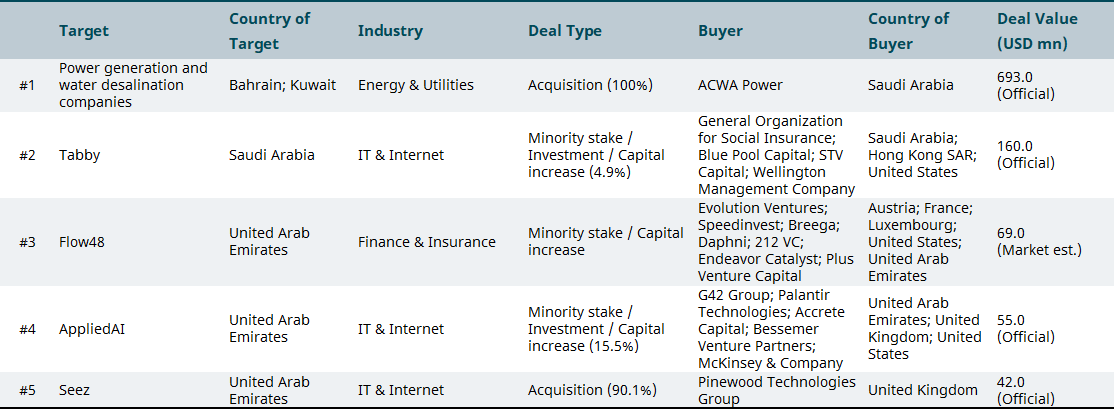

Middle East & Africa

Saudi-based ACWA Power has signed a USD 693mn deal to acquire stakes in four power and water desalination assets in Kuwait and Bahrain from French utility developer ENGIE, marking ACWA’s entry into the Kuwaiti market and expanding its regional footprint. The acquisition includes 4.61 GW of gas-fired power capacity and 1.11 million m³/day of desalinated water, along with related operation and maintenance firms. The move strengthens ACWA Power’s position as a global leader in water desalination and supports its goal to triple its assets under management to USD 250bn by 2030.

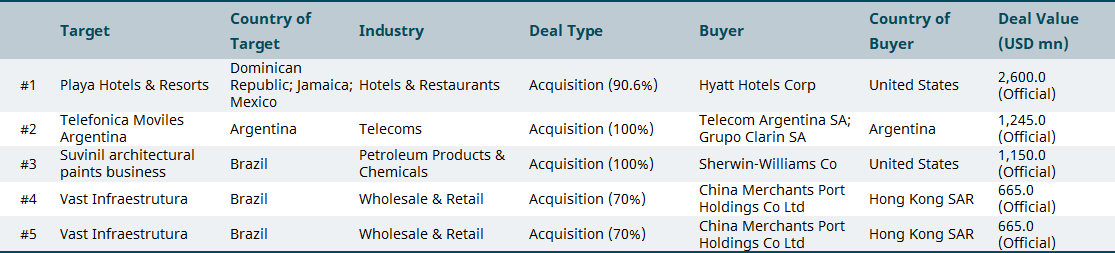

Latin America and the Caribbean

U.S. hotel giant Hyatt announced the acquisition of a 90.6% stake it does not own in Netherlands-based Playa Hotels & Resorts for USD 2.6bn, including USD 900mn in net debt. Playa owns and operates beachfront resorts across Mexico, Jamaica, and the Dominican Republic. The deal expands Hyatt’s portfolio and enhances its all-inclusive management platform.

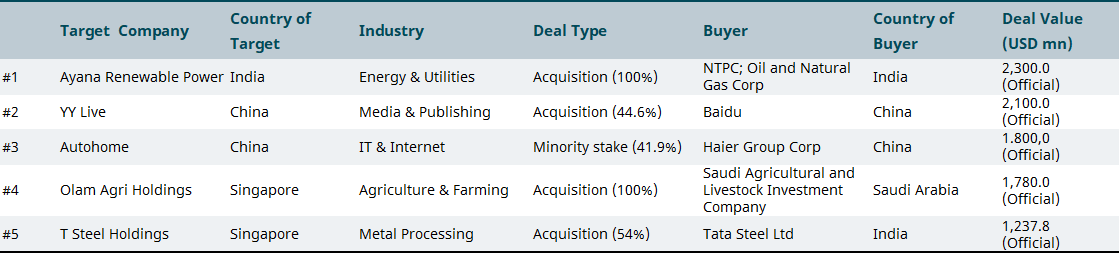

Emerging Asia

ONGC NTPC Green has announced the acquisition of Ayana Renewable Power Pvt for USD 2.3bn from National Investment and Infrastructure Fund (NIIF), British International Investment, and EverSource Capital. ONGC NTPC Green is a joint venture between Oil and Natural Gas Corporation Ltd (ONGC), India’s largest government-controlled oil and gas exploration company, and NTPC Ltd, the country’s largest state-owned power producer. The deal reinforces its commitment to clean energy and supporting ONGC’s and NTPC’s net-zero goals for 2038 and 2050, respectively. Ayana’s strong solar, wind, and hybrid portfolio across India will provide the foundation for scaling the JV’s green energy operations.

Are you interested in M&A intelligence? Request a demo of our platform here