August 2024 top M&A deals in emerging markets by region

By EMIS DealWatch

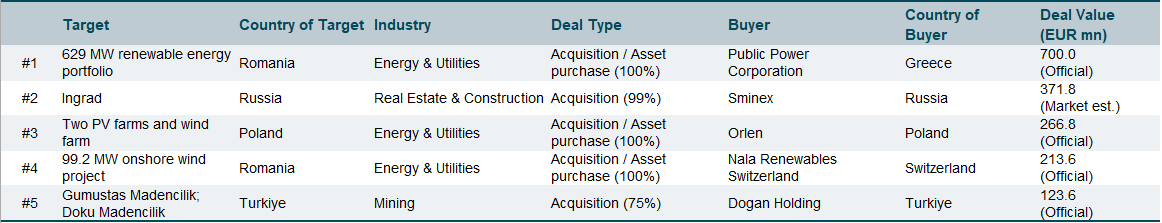

Emerging Europe

Greek energy group Public Power Corporation (PPC) announced it will acquire a 629 MW renewable energy portfolio from Romanian company Evryo Group for EUR 700mn. Expected to close in Q4 2024, the acquisition will double PPC's renewable capacity in Romania, bringing its total operational portfolio to 5.3 GW. The portfolio includes 600 MW of onshore wind, 22 MW of hydropower, 6 MW of BESS, and 1 MW of photovoltaic projects. PPC is Greece's leading energy provider, while Evryo Group is owned by Australia's Macquarie Group.

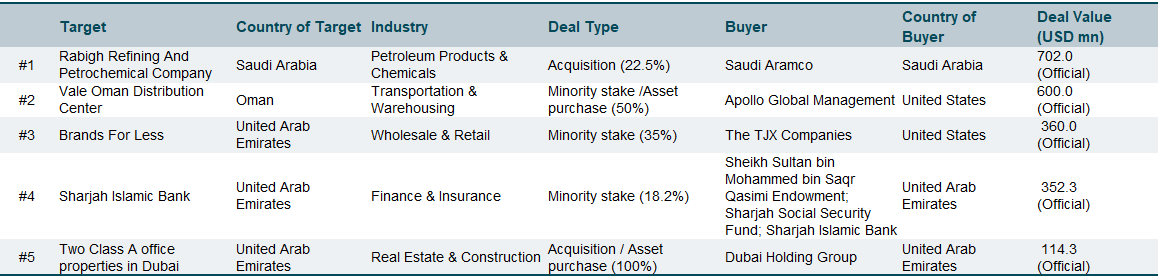

Middle East & Africa

Saudi Aramco announced it will acquire an additional 22.5% stake in oil refiner Petro Rabigh from Japan’s Sumitomo Chemical for USD 702mn, increasing Aramco's stake to 60%, while Sumitomo will retain 15%. Aramco and Sumitomo also agreed to enhance Petro Rabigh's financial position by waiving USD 1.5bn in revolving loans and injecting USD 1.4bn in new funds. Petro Rabigh, a joint venture between Aramco and Sumitomo, produces refined petroleum and petrochemical products, processing 400,000 barrels of crude oil per day.

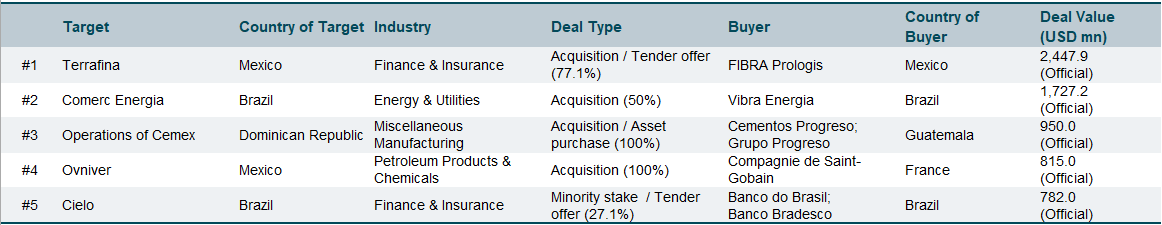

Latin America and the Caribbean

FIBRA Prologis, a leading Mexican real estate investment trust acquired a 77.1% stake in peer Terrafina for approximately MXN 45.9bn (USD 2.5bn), including debt. The transaction strengthens FIBRA Prologis' leading position in Mexico's booming industrial real estate market, driven by nearshoring trends. Terrafina’s portfolio includes 3.9 million m2 of industrial space across 288 warehouses, complementing FIBRA Prologis’ holdings of 4.4 million m2.

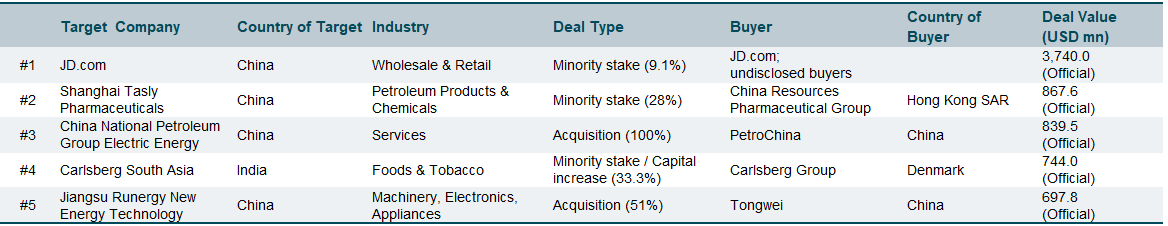

Emerging Asia

U.S. retail giant Walmart Inc sold its stake in Chinese e-commerce company JD.com for USD 3.6bn as part of its strategy to refocus on core operations. Despite the sale, Walmart will maintain its commercial partnership with JD.com. Walmart initially acquired a 5% stake in JD.com in 2016 to enhance its retail business in China, eventually increasing its stake to about 10%. JD.com, which operates extensive logistics facilities, reported USD 152.8bn in revenue in 2023.

Are you interested in M&A intelligence? Request a demo of our platform here