ASEAN’s Strategic Convergence: Powering Green Mobility and Electronics

ASEAN is becoming a focal point for the global electric vehicle, battery and semiconductor industries, as changing supply chains bring the region’s manufacturing strengths into closer alignment. Semiconductors are already a strategic input with the global market projected to reach USD 1tn by 2030, according to forecasts by the Economic Research Institute for ASEAN and East Asia. Electric vehicle (EV) adoption, on the other hand, is shifting decisively toward emerging Asia. Global EV sales reached a record 17.5mn units in 2024 and stood at a little over 20mn in 2025, but while growth in Europe and the US has slowed, emerging Asian markets are accelerating, with EV sales in key ASEAN economies already surpassing US penetration levels. The region’s long-standing strengths in electronics assembly and automotive manufacturing are now beginning to converge, creating the foundations of a regional value chain that links chips, batteries and vehicles. Far from being incidental, this evolution is being actively driven by global industry trends and strategic policy choices.

Aligning Strengths

Across ASEAN, strengths that once sat in parallel - electronics assembly and automotive manufacturing - are beginning to converge into a powerful EV-semiconductor ecosystem. The region already holds a competitive advantage in assembly, testing and packaging (ATP) and supplies the power devices and sensors that electric vehicles increasingly depend on - by 2032, Southeast Asia is seen accounting for about a quarter of global ATP capacity. The presence of global industry leaders such as Intel, Infineon, and Micron underscores investor confidence, while high-volume plants such as Infineon’s facility in Batam, Indonesia, demonstrate that the country and, by extension, the ASEAN region, can operate capital-intensive, precision manufacturing at global scale, meet stringent quality and reliability standards, and secure a position in fast-growing sectors such as EVs, electronics, and industrial automation.

At the same time, EV adoption is accelerating across the region. Thailand has emerged as ASEAN’s largest EV market, Indonesia and Vietnam are posting some of the fastest growth rates globally, and investment from Japanese, Chinese and regional automakers is reshaping production footprints.

With its large electronics manufacturing base and cost competitiveness, Vietnam is evolving into a hub for EV system integration and assembly, and semiconductor assembly, packaging and testing. Malaysia’s Penang has been moving upstream into design, engineering and R&D for advanced electronics, and Singapore is ASEAN’s centre for semiconductor R&D and high-end EV and battery systems development.

Individually, these are national success stories. Together, they point to something larger - a region capable of linking materials, chips, batteries and vehicles into a single, integrated value chain.

Semiconductors: The Core Enabler

Semiconductors have become a foundational input for the global economy, underpinning everything from smartphones and electric vehicles to artificial intelligence and advanced defence systems.

ASEAN is one of the major global hubs for semiconductor production. The industry is turning into an ecosystem encompassing production processes, value chains, countries, companies, and production facilities. It serves as a catalyst for establishing regional production networks and for deepening cross-industry links with consumer electronics, automotive, AI, etc. Industry investment continues to grow.

ASEAN Semiconductors International Investment

![]()

Source: ASEAN Investment Report 2025

Semiconductors Average Share in Total Greenfield Investment, 2021-2024

![]()

Source: ASEAN Investment Report 2025

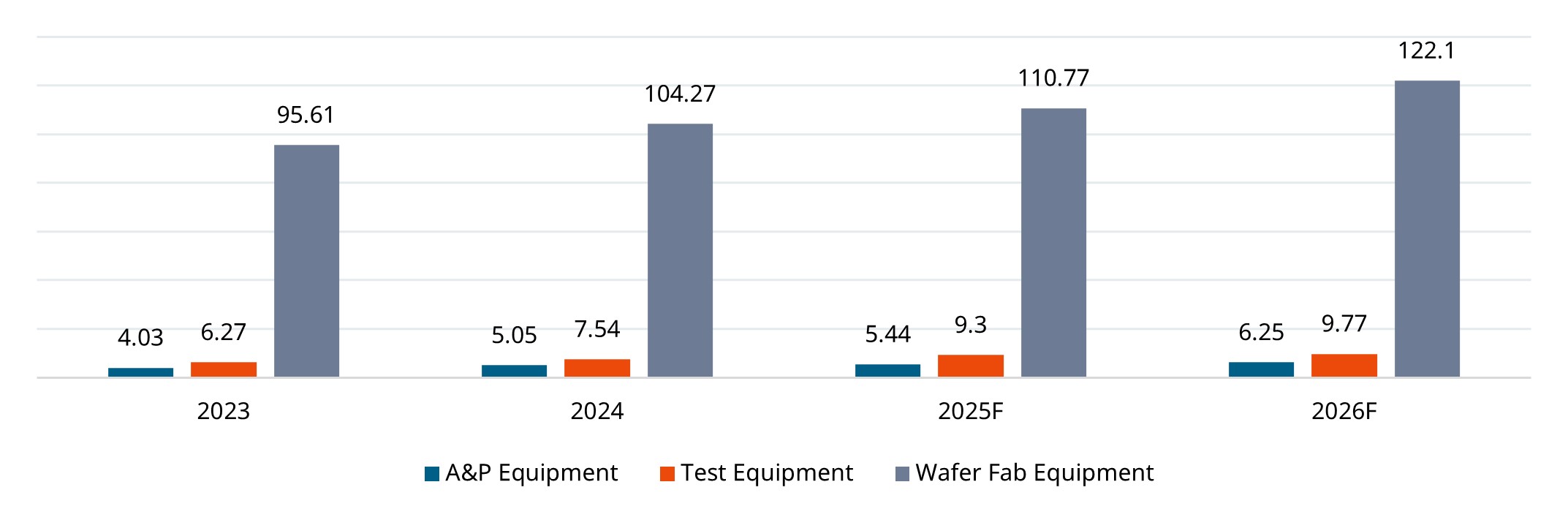

Semiconductor association SEMI expects global sales of total semiconductor manufacturing equipment by original equipment manufacturers (OEMs) to hit a record USD 125.5bn in 2025, with a further increase to USD 138.1bn the following year. Back-end equipment, an area where ASEAN excels, is set for particularly strong momentum, with test equipment revenue estimated at USD 9.3bn in 2025.

Total Semiconductor Equipment Sales Forecast, USD bn

Source: SEMI

ASEAN’s role in global semiconductor trade has expanded sharply, with its share of export growth rising from about 20% in 2015 to nearly 30% in 2024. The region’s rich deposits of nickel, rare earths, cobalt and tin reinforce its long-term strategic relevance by linking upstream resources with high-value electronics manufacturing.

Governments across ASEAN are now pursuing coordinated strategies to elevate their positions. Emerging frameworks such as the proposed ASEAN Integrated Semiconductor Supply Chain initiative aim to harmonise standards, improve resilience, and position the region as a trusted, neutral hub.

Singapore is undoubtedly ASEAN’s most advanced production base. Malaysia complements Singapore by dominating assembly, testing, and packaging, while gradually building expertise in wafer fabrication and chip design. Indonesia is positioning itself as an emerging contender, linking semiconductor ambitions to its broader industrial-downstreaming strategy. With abundant silica sand and plans to restrict raw material exports by 2027, it is seeking foreign partners to help establish local wafer and chip manufacturing. Vietnam’s semiconductor industry is on a rapid growth trajectory, with market value projected to reach USD 31bn by 2027. To sustain this momentum, the Vietnamese government has launched a national semiconductor strategy aimed at creating a comprehensive domestic ecosystem by 2050.

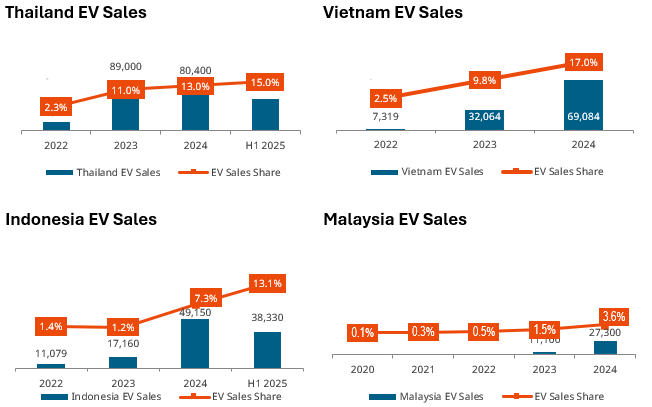

Green Transition: The Growth Engine

EV adoption is increasingly shifting toward emerging Asia as global growth becomes more uneven. Global EV sales (BEV and PHEV) rose 28% y/y to a record 17.5mn units in 2024, driven mainly by China and emerging markets, while sales in Europe stagnated and US growth slowed markedly. In emerging Asia (excluding China), EV sales climbed over 40% y/y to nearly 400,000 units, led by India (just over 92,000) and fast-growing ASEAN markets such as Thailand (80,400) and Vietnam (nearly 70,000, more than double y/y). The combined EV sales in four key ASEAN countries - Thailand, Vietnam, Malaysia and Indonesia - reached 226,000 units in 2024, with EV penetration averaging 10.2%, already surpassing the US share of 10%. EVs, mostly ones produced by local manufacturer VinFast, accounted for almost 40% of Vietnam’s new car sales in 2025 and the country is catching up with regional leader Singapore in terms of share of EVs in new car sales. The growth in EV sales across the region has been nothing short of remarkable – in Vietnam, for example, the EV sales share was less than 0.05% as recently as in 2021.

Source: IEA, FTI, PwC, aggregated by EMIS

ASEAN governments are making focused efforts to advance their EV agendas. According to publications available on EMIS, Thailand, Indonesia, Malaysia, and Vietnam have been among the most active ASEAN economies in pursuing these goals. In 2022, Thailand introduced its EV 3.0 incentive package, allowing duty-free imports under the condition that EV producers begin local EV assembly. Indonesia has aggressively supported EV adoption through tax incentives, starting with a VAT cut to as low as 1% in April-December 2023 for EVs with over 40% local content, and 6% for those with 20%-40% domestic components. In 2024, the government extended and expanded these measures by scrapping luxury taxes, abolishing import duties until end-2025, maintaining the 1% VAT rate, and offering additional tax incentives to carmakers investing in local EV manufacturing. Vietnam’s rapid EV growth is underpinned by the National Action Program for Green Transportation launched in 2022, which lays out a roadmap for decarbonising road transport through 2050. The plan promotes EV manufacturing, imports, and charging infrastructure through 2030, then progressively restricts fossil fuel vehicles from 2031, aiming to end their domestic production and imports by 2040 and achieve 100% electric or green-energy road transport by 2050. In Malaysia companies involved in the production of EV charging equipment can receive a 100% income tax exemption on their statutory income from 2023 to 2032.

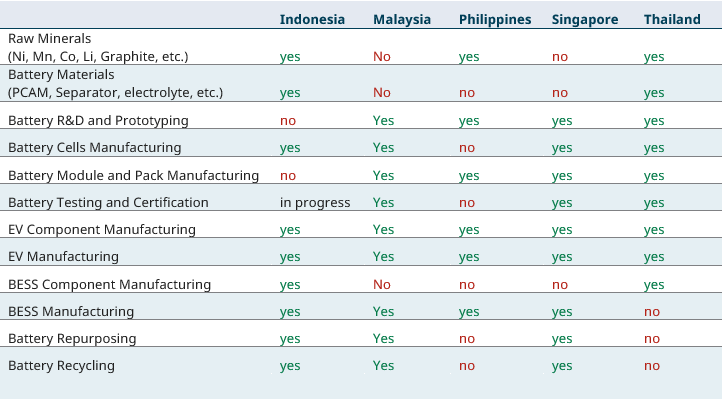

Against this backdrop, as countries accelerate the shift toward cleaner energy systems, batteries are emerging as a critical industrial technology underpinning electric vehicles and grid-scale energy storage. For ASEAN, this transition presents both a growing domestic market and a strategic opportunity to build a regional battery ecosystem albeit from a relatively late starting point compared with established leaders such as China.

Energy demand in Southeast Asia is rising rapidly as urbanisation and incomes increase across a population of more than 670 million. Governments increasingly view EV adoption as a way to reduce oil dependence and urban pollution, while battery energy storage systems (BESS) are becoming essential for stabilising power grids as solar and wind capacity expands.

EV battery and BESS manufacturing in ASEAN has been gaining momentum but remains uneven. Indonesia was the only ASEAN country among the top 15 in Bloomberg’s latest global lithium-battery supply-chain ranking, occupying the 13th position. The country has leveraged its dominant nickel reserves to attract large-scale investment, most notably a multi-billion-dollar EV battery project backed by Chinese battery manufacturer CATL. While this signals ambition to become a regional battery hub, Indonesia should step up the development of local precursors and cathode materials capacity in order to reduce exposure to foreign trade volatility.

ASEAN Battery Industry Value Chain

Source: Singapore Battery Consortium

The Interconnected Tech Ecosystem

With electric vehicle and battery production gaining pace across Southeast Asia, the region has a chance to connect its expanding semiconductor base to the EV supply chain and carve out a central role in the global green mobility transition.

Electric vehicles run on far more than batteries alone. Chips manage everything from energy flow and motor control to navigation, safety features and digital dashboards. As vehicles become smarter and more software-driven, their reliance on semiconductors intensifies, thus playing to ASEAN’s strengths in electronics and chip-related manufacturing.

Much of ASEAN’s current strength in semiconductor manufacturing lies in assembly, testing and packaging, where Malaysia, Vietnam and the Philippines are particularly competitive, notably in power devices and sensor-related components that are essential for electric vehicles. These downstream capabilities provide a solid base for deeper integration between the semiconductor and EV value chains.

ASEAN’s advantage is reinforced by its access to key raw materials. Indonesia controls a dominant share of global nickel reserves, Vietnam is a major holder of rare earth elements, while the Philippines and Malaysia contribute meaningfully to supplies of cobalt and tin. Together, these inputs underpin both battery production and advanced chip manufacturing.

Simultaneously, the ASEAN EV market is booming. Vietnam is emerging as a combined EV and semiconductor hub, supported by projects from Intel, Amkor and VinFast, while Malaysia is strengthening its role in chip design and R&D. By combining these complementary strengths across borders, ASEAN has the potential to evolve into a tightly integrated, high-value manufacturing ecosystem rather than a collection of standalone production bases.

Global Supply Chain Impacts

ASEAN’s tech build-out comes at a time of strategic shifts in global supply chains. The region has been one of the primary beneficiaries of the policy of diversifying manufacturing footprints to reduce risk related to trade tensions, geopolitical conflict, and other disruptions.

As more chips, electronics and battery components are made in ASEAN, global trade flows are changing.

From 2023 to 2031, ASEAN’s export performance is expected to accelerate far faster than global trade, with Boston Consulting Group projecting regional exports to climb by almost 90% to around USD 3.2tn a year, compared with global trade growth of under 30%. This expansion is being underpinned by deeper supply-chain integration within ASEAN across several sectors including automotive and auto components, and consumer electronics. Nowhere is this reconfiguration more visible than in electric vehicles. As EV volumes scale up, automakers are reshaping both production footprints and logistics strategies. Chinese EV brands are increasingly localising manufacturing in Indonesia, Thailand and, more recently, Vietnam, building plants for vehicles, components and batteries to supply regional markets. Japanese automakers, in turn, are consolidating operations in comparatively resilient hubs such as Malaysia and the Philippines. These strategic shifts are generating new trade patterns, with rising cross-border flows of parts and semi-finished products within Southeast Asia. Intra-ASEAN trade in complete knock-down (CKD) kits and automotive components is increasing, particularly along corridors linking Thailand, Indonesia, Vietnam and the Philippines.

Looking Ahead

ASEAN now stands at a pivotal moment. The alignment of its growing semiconductor capabilities with accelerating EV ambitions, reinforced by the reserves of critical minerals, creates a rare opportunity for the region to play a central role in the global shift toward clean mobility. In order to live up to this potential, it needs sustained investment, coordinated policy frameworks, and deeper regional cooperation.

To learn more about the EMIS ASEAN coverage, visit https://info.emis.com/emis-asean.

About ISI Markets

ISI Markets comprises four brands: CEIC, EMIS, REDD and EPFR, that share a common purpose to illuminate the opportunity in emerging and developed markets where information can be hard to obtain and even harder to rely upon. We leverage deep local knowledge, well-established networks and leading-edge software and advanced analytics to deliver intelligence that informs our clients’ investment, strategic and risk decisions. For more information, please visit www.isimarkets.com

About EMIS

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest-growing markets. We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools. EMIS delivers trustworthy intelligence covering more than 370 industry sectors and 17 million companies across 197 markets, providing everything you need in one place as actionable insights are facilitated by leading technology. EMIS is part of ISI Markets. www.emis.com

Media Contact

ISI Markets

Pranav Parekh

Regional Marketing Manager

pparekh@isimarkets.com