April 2025 top M&A deals in emerging markets by region

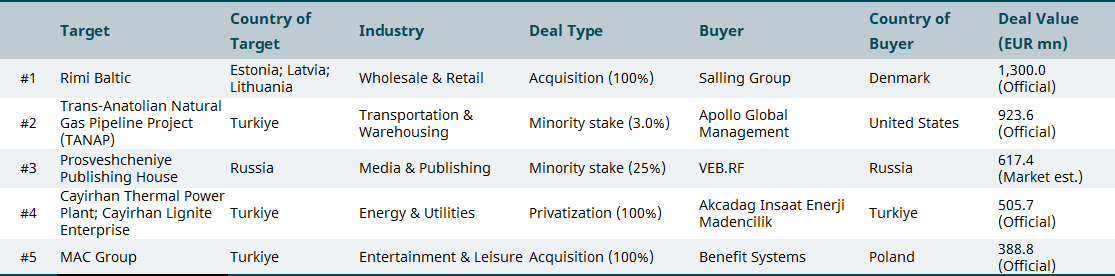

Eastern Europe

Swedish retail giant ICA Gruppen agreed to sell its Baltic business, Rimi Baltic, to Denmark’s Salling Group for EUR 1.3bn, as it refocuses on its core Swedish market. The deal marks Salling Group’s strategic expansion into the Baltics. Rimi Baltic operates 314 stores across Estonia, Latvia, and Lithuania under the Rimi Hyper, Super, Mini, and Express brands, employing around 11,000 people. In 2024, it generated nearly EUR 2.0 bn in revenue.

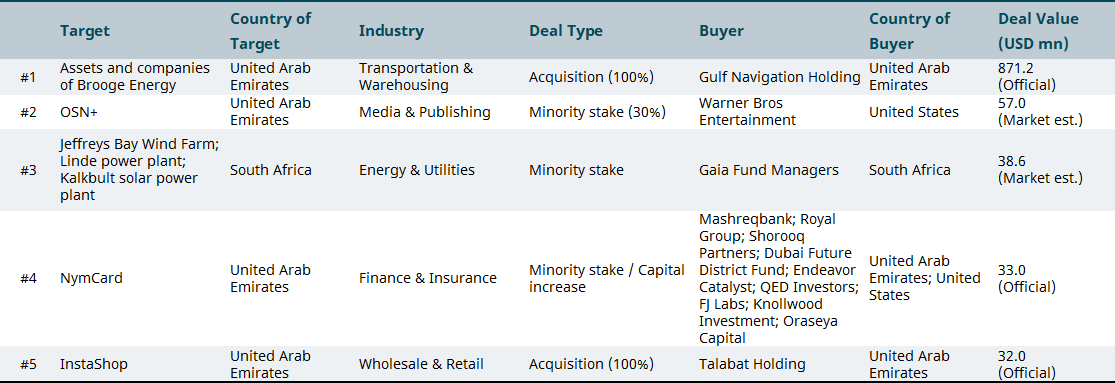

Middle East & Africa

UAE-based Gulf Navigation Holding has secured shareholder approval for a strategic acquisition of assets and companies from Brooge Energy Limited (BEL) valued at AED 3.2bn (USD 871.2mn). The acquisition includes Brooge Petroleum and Gas Investment Company and related entities. It strengthens Gulf Navigation’s position in midstream oil logistics, expanding its capabilities in storage and refining via BEL’s Fujairah-based infrastructure.

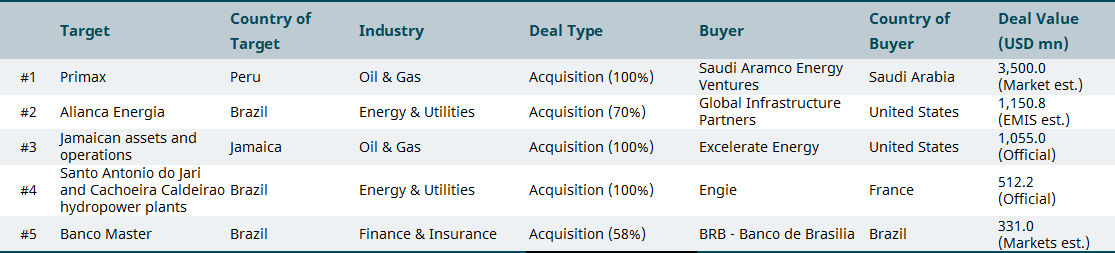

Latin America and the Caribbean

Saudi oil giant Aramco has acquired Primax, a leading fuel distribution company in Latin America, from Peru’s Grupo Romero in a deal valued at USD 3.5bn, according to local reports. The acquisition gives Aramco control of 2,185 petrol stations across Peru, Colombia, and Ecuador, significantly expanding its footprint in the Americas. Primax was formed through the merger of Romero Trading’s fuel division and Chile’s ENAP, following the acquisition of Shell Peru’s fuel business.

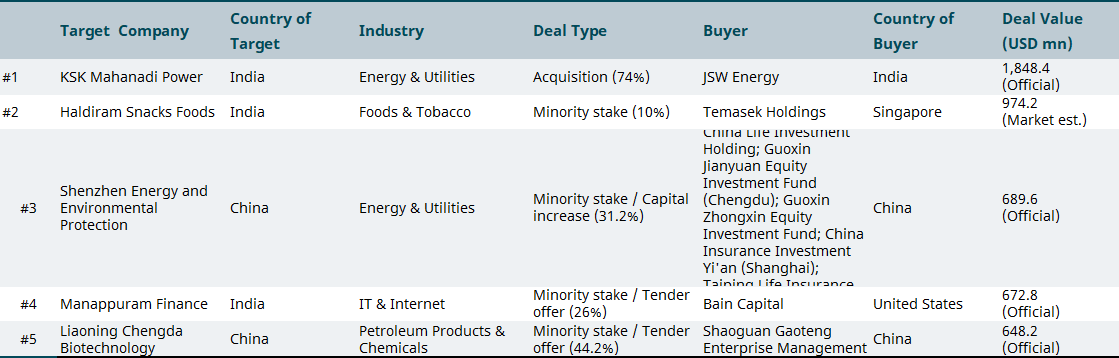

Emerging Asia

Indian power firm JSW Energy has acquired a 74% equity stake in KSK Mahanadi Power for USD 1.85bn as part of a resolution plan under India’s Insolvency and Bankruptcy Code (IBC). The remaining 26% stake will be held by financial creditors. KSK Mahanadi operates a 3.6 GW coal-fired power plant in Chhattisgarh, with 1,800 MW operational and another 1,800 MW under construction.

Are you interested in M&A intelligence? Request a demo of our platform here